Evergrande China Stock, Zksawczzcgxj4m

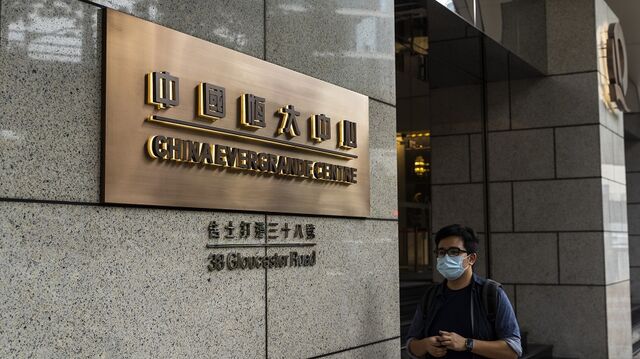

Evergrande - the worlds most indebted developer - is also under pressure after its affiliates missed payments and a report said regulators are probing its ties to an obscure bank in northern China. June 07 2021 1553 IST.

Evergrande Property Services Group slumped in Hong Kong by the most since its December listing after an unidentified seller offloaded several blocks of shares as soon as a six-month lock-up period on key investors expired on Wednesday.

Evergrande china stock. It is based in southern Chinas Guangdong Province and sells apartments mostly to upper and middle-income dwellers. Chinese regulators have instructed major creditors of China Evergrande Group to conduct a fresh round of stress tests on their exposure to the worlds most indebted developer according to people. - China Evergrande announced on June 7 that it bought back 291 million shares worth a total of HK336 million 43 million according to a Hong Kong Stock Exchange filing.

Suning Appliance and its subsidiaries have US46 billion of bonds outstanding both onshore and offshore including a US600 million note due in September data compiled by Bloomberg showed. Billionaire Zhang Jindongs 30-year old empire is facing a critical test as concern mounts over Suning Appliance Group Cos financial health and its links to China Evergrande Group. Chinas Evergrande says it is arranging payment for unpaid commercial paper.

Resurgent concerns about the health of China Evergrande Group Huis flagship property company have pushed its stock to within a hairs breadth of the lowest level since March 2020. SHANGHAI HONG KONG. The company paid HK1108 to HK1184 apiece for the shares about 02 of issued capital it said in a filing to the exchange late Monday.

Debt-laden China Evergrande Arranges 175 Billion of Funds to Repay Offshore Bonds HONG KONG Reuters -Chinas most indebted property developer said it had arranged its own funds of HK136. The stock sank 13 per cent to HK978 at the close of trading on Wednesday erasing the equivalent of US19 billion from its market value. China Evergrande Group placed 260 million shares or 266 of issued share capital of China Evergrande New Energy Vehicle Group Ltd for HK106 billi.

Moodys Investors Service downgraded China Evergrande Groups credit rating by one notch to B2 as the debt-ridden property developer struggles to ease its debt crunch. Best not to bet against passive fund flows. Chinas most indebted property developer Evergrande Group said on Monday that it was.

The stock climbed 24 as of 1036 am. HONG KONG Reuters - China Evergrande Group said on Tuesday its interest-bearing indebtedness has dropped to around 570 billion yuan 8823 billion from 7165 billion yuan at. China Evergrande unit slides by record in US19 billion sell-off as seller offloads stock after lock-up period expires Several blocks totalling 270 million shares were traded at HK980 each a.

Evergrandes debt problem has become a major investor concern since a leaked document in September showed the developer sought government help to avert a cash crunch. Bloomberg China Evergrande Group the countrys most indebted developer rose in Hong Kong trading after the company bought back HK336 million 43 million of shares. The Evergrande Group or the Evergrande Real Estate Group previously Hengda Group is Chinas second-largest property developer by sales making it the 122nd largest group in the world by revenue according to the 2021 Fortune Global 500 List.

Chinas most indebted property developer said it had arranged its own funds of HK136 billion 175 billion to repay bonds due on Monday as well as to pay interest on all other dollar bonds. HONG KONG -- China Evergrande Group the worlds most indebted property developer has arranged to use 175 billion of its own funds to redeem offsho. The downgrade reflects Evergrandes weakened funding access and reduced liquidity buffer given its large debt maturities in the coming 1218 months amid the tight credit environment in China and volatility in the capital.

Resurgent concerns about the health of China Evergrande Group Mr Huis flagship property company have pushed its stock to within a hairs breadth of the lowest level since March 2020. Chinas most indebted property developer Evergrande Group 3333HK plans to repay its 147 billion offshore bond maturing next Monday this week ahead of schedule a source close to Evergrande said. Chinas other tech giants such as Tencent Holdings Ltd.

And Meituan are also among the largest holdings of the benchmark MSCI Emerging Markets Index. Local time on Tuesday. China Evergrandes top creditor has trimmed its loans to the nations most-indebted developer to assuage investors a sign lenders have started to raise their guard against default risks.

China S Nightmare Evergrande Scenario Is An Uncontrolled Crash Bloomberg