Policybazaar Ipo / Pb Fintech Ipo Policybazaar Ipo Price Gmp Today Date Review

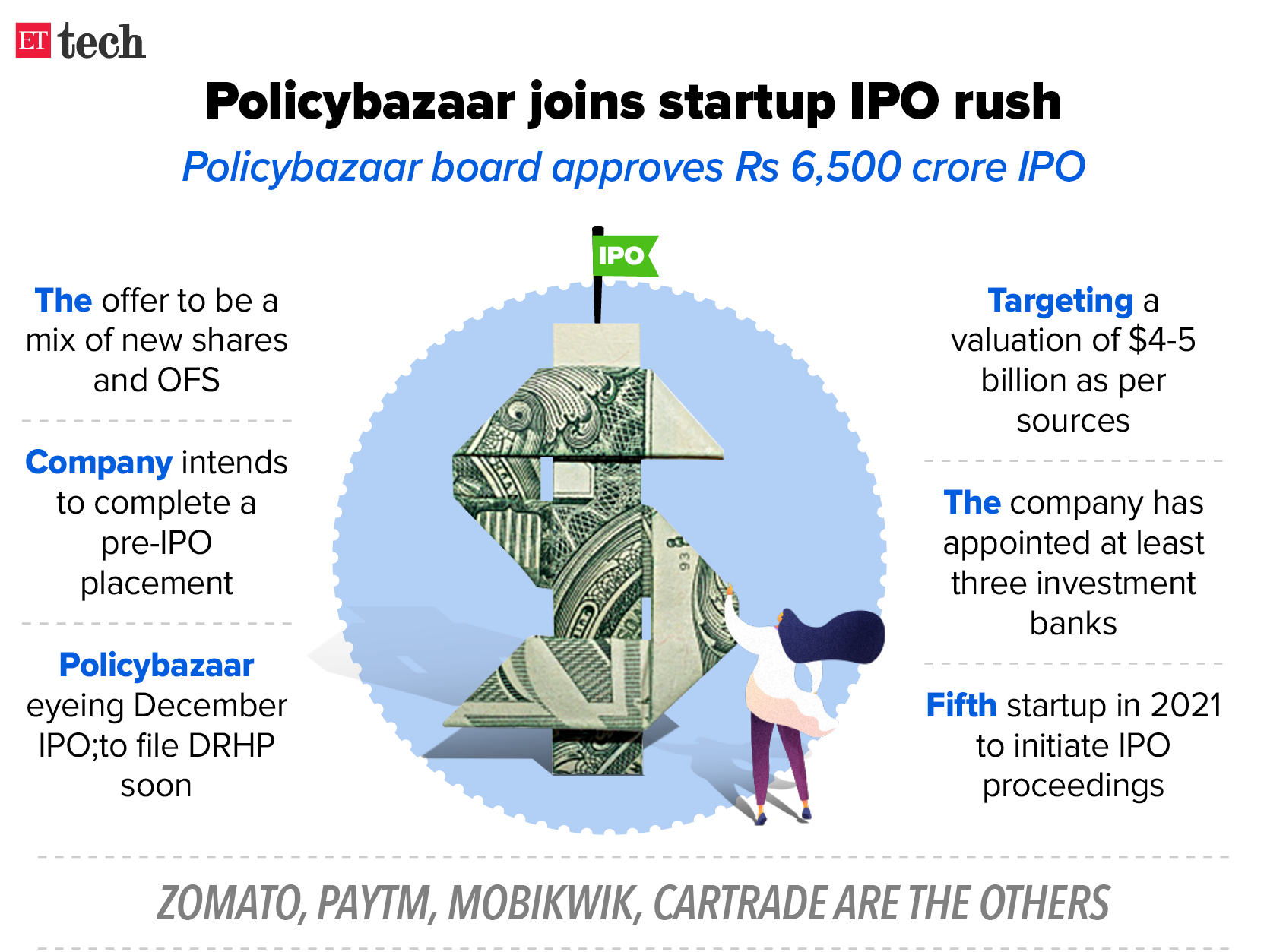

The public issue comprises a. Policybazaar is said to be seeking a valuation of as much as 5 billion in the IPO up from 24 billion at the last funding round.

From Existential Crisis To Ipo Policybazaar S Decade Long Journey To Dalal Street

What is the listing date of PolicyBazaar Fintech Limited.

Policybazaar ipo. Policybazaar parent company PB Fintechs Rs 5625-crore IPO opened for subscription on Monday 1 November 2021. Policybazaar parent PB Fintech has approved a resolution to raise up to Rs 6500 crore or 870 million via an IPO making it the fifth Indian startup to initiate proceedings to list on the national bourses. PolicyBazaar IPO is a main-board IPO of equity shares of the face value of 2 aggregating up to 562500 Crores.

Link Intime India Private Ltd is the registrar for the IPO. We offer an online platform for insurance buyers where they can easily compare different insurance policies such as car insurance life insurance two-wheeler insurance term insurance retirement plans etc. PB Fintech which is the parent entity PolicyBazaar and.

The company is going to raise around 601750. PB Fintech aka Policybazaar IPO Allotment to be finalized by Linkintime on November 10 2021. IPO Price 940 to 980.

PolicyBazaar IPO Allotment Date. Policybazaar raises Rs 2569 crore from insurance cos others in IPO anchor round. The category for qualified institutional buyers QIBs booked 272 times while that for non-institutional investors.

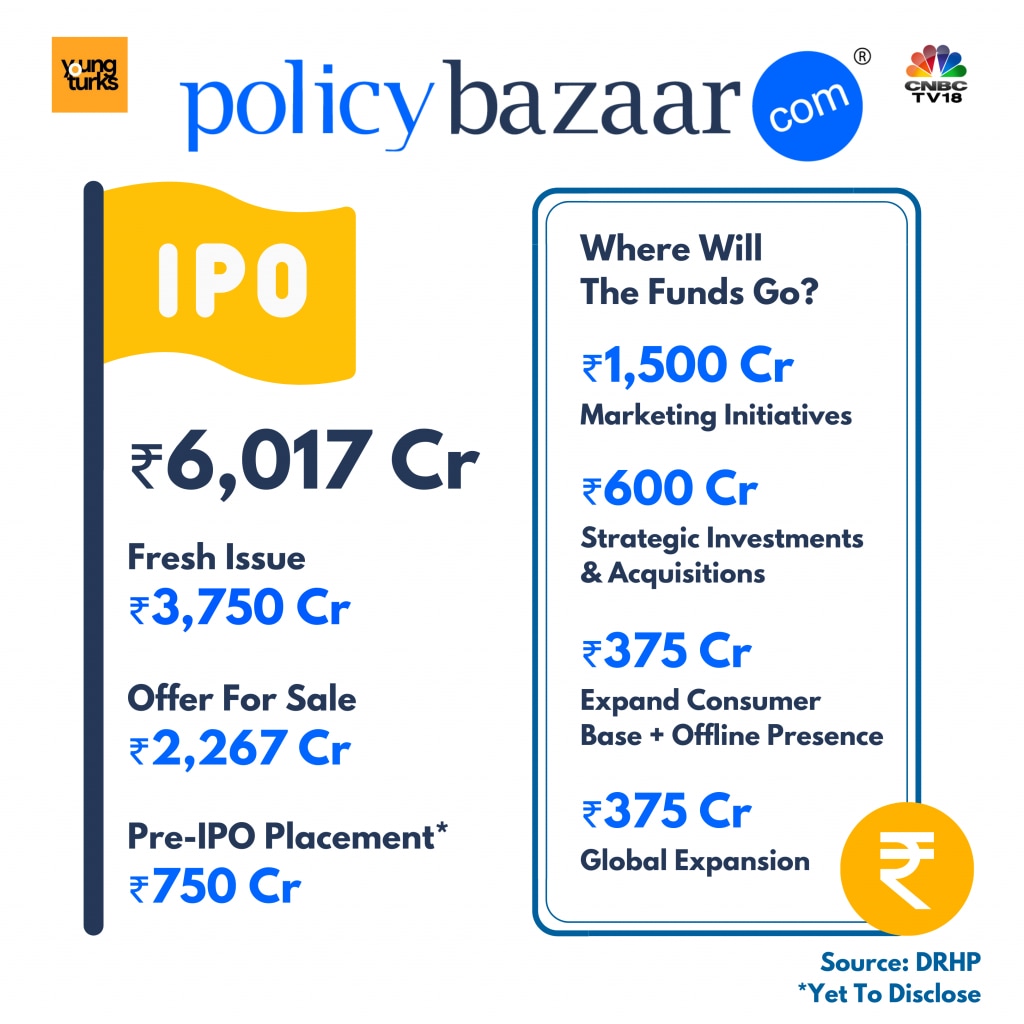

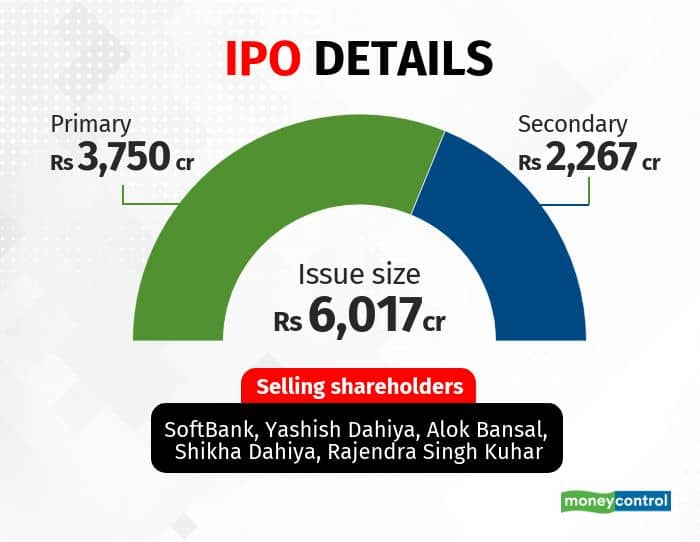

Policybazaar IPO issue size combines a fresh issue of Rs3750 crores and an offer for sale of Rs22675 crores. PB Fintech parent company of PolicyBazaar has announced to open its IPO on November 1 and close on November 3. - Indias Policybazaar filed on Aug.

The minimum order quantity is 15 Shares. The internet company has set a price band of 940-980 per share. PolicyBazaar IPO is around the corner and to hit the market on 01 November 2021.

- The insurance. 2 for an initial public offering to raise up to 602 billion rupees 810 million from the sale of new and existing shares. They are one of the largest online insurance platform.

The initial public offering IPO of PB Fintech which operates Policybazaar and Paisabazaar opened for subscription on Wednesday. PolicyBazaar IPO Details. On day 3 as of 1110 am Policybazaar IPO has been subscribed 202 times.

Book Built Issue IPO. PolicyBazaar Fintech Limited IPO will open on 01 Nov 2021 and close on 03 Nov 2021. Policybazaar IPO allotment is will be available on November 10 on Linkintime website.

The allotment status of PB Fintech Limited IPO is now available online. PolicyBazaar IPO subscription to start from Nov 01 to Nov 03 2021. PB Fintech is the parent company of PolicyBazaar and PaisaBazaar.

They have built Indias largest online platform for insurance and lending products leveraging the power of technology data and innovation according to. The issue is priced at 940 to 980 per equity share. Please check the IPO allotment status on the Linkintime registrar as on the allotment date.

PB Fintech is a leading online platform for insurance and lending products leveraging the power of technology data and innovation. The equity shares of the company to be list at BSE NSE. PolicyBazaar offering transparent insurance information to potential customers for years is now looking towards more growth and hence coming up with the Initial Public offerings.

Fresh issue 3750 Cr. PolicyBazaar IPO Allotment Status Thursday November 11 2021 12935 AM. Based out of Gurgaon Haryana PolicyBazaar is an insurance broker approved by IRDA of India.

The public issue of PolicyBazaar IPO was open on Nov 1 2021 and closed for subscription on Nov 3 2021. The Rs 5710-crore IPO comprises a fresh issue of Rs 3750 crore worth of equity shares and an offer for sale of about Rs 1960 crore by existing shareholders. SoftBank owns about 13 stake in the IPO-bound company and is its largest shareholder.

The IPO opens on Nov 1 2021 and closes on Nov 3 2021. Face Value 2 per equity share. Policybazaar IPO Allotment Date Status.

The company to raise 60175 crores via IPO that comprises 3750 crore of fresh issue and offer for sale up to 226750 crores. Issue Size 570864 Cr. It provides convenient access to insurance credit and other financial products.

Policybazaar IPO Indias largest online platform for insurance and lending products mobilised Rs 5625 crore through the public issue that was subscribed 1658 times. The price range for the offer has been fixed at Rs 940 Rs. Summary of PolicyBazaar IPO.

Policybazaar Ipo Comes Amid Move By Dominant Insurance Players To Delist All Their Products From Online Insurance Marketplace

Policybazaar Ipo Announced Check Subscription Date Price Band And More News Zee News

Policybazaar Plans Ipo To Raise Up To Rs 6 500 Crore The Economic Times

Policybazaar Ipo Policybazaar Eyes 1 5 Billion Value In Ipo Business Times Of India

Policybazaar S Ipo Plans In 5 Charts

Pb Fintech Aka Policybazaar Raises 2569 Crore From 155 Anchor Investors Correct Success

Policybazaar Ipo Next Pb Fintech Planning Rs 6 500 Cr Fundraise At 5 Bn Valuation

Policy Bazaar Ipo Gmp Dates Review Important Detail 2021

Policybazaar Ipo Opens Next Week Should You Apply

Policy Bazaar Ipo Apply Details Online Offline Upi Asba

Policybazaar Makes Stock Market Debut Shares List At 17 35 Premium To Ipo Price

Policybazaar Ipo Analysis Release Date Gmp Price Band Ipo Tips Learn2finance

Softbank Backed Indian Insurance Platform Policybazaar Files For 809m Ipo Asia Financial News

Policybazaar Parent Get Ipo Nod From India Regulator Report

Pb Fintech Ipo Policybazaar Ipo Price Gmp Today Date Review

Policybazaar Plans Ipo To Raise Up To Rs 6 500 Crore The Economic Times

Policybazaar Ipo To List On Bourses Today Know Investors Strategy For This Issue From Anil Singhvi Zee Business

Policy Bazaar Ipo Date Policy Bazaar Ipo Launch Date Policy Bazaar Ipo Size Policy Bazaar Share Price Pb Fintech Ipo Markets News India Tv